By 31 March of the following year. Income tax return for partnerships Form P.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Yearly remuneration statement Form EA Deadline. Efiling submissions for the 2021 Income Tax Returns for.

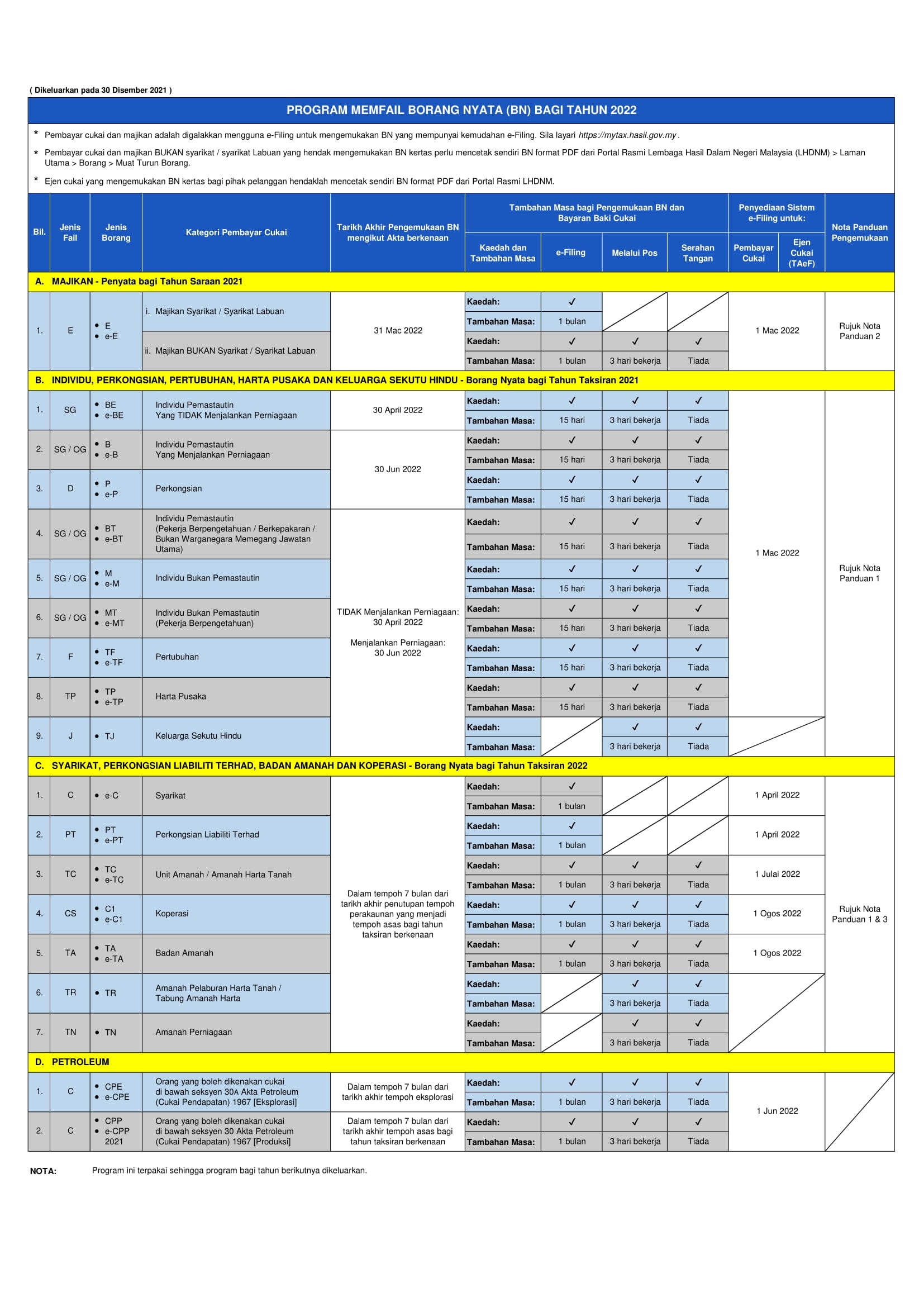

30062022 15072022 for e-filing 6. Other entities Submission of income tax return. Form E Important Notes.

Employment income BE Form on or before 30 th April. 30042022 15052022 for e-filing 5. Tax return filing and payment deadlines extended by two months March 23 2020.

Employment income e-BE on or before 15 th May. During an audit a tax agent would check all information related to your income and expenses. The total relief for each unmarried child and under the age of 18 years old is RM2000.

The Inland Revenue Board IRB has recently made available on its website the 2021 income tax return filing programme 2021 filing programme titled Return Form RF Filing Programme For The Year 2021. CompareHeromy April 5 2021 14360. Income tax return for individual who only received employment income.

Form EA Important Notes. Form P refers to income tax return for partnerships. Calendar year accounting period ending.

Income Tax For Foreigners Working in Malaysia 2021. However in this article well be solely focusing on Malaysia Personal Individual Income Tax YA2021 that is tax paid by employees in Malaysia. The total relief of RM9000 is for an individual in respect of himself and his dependent relatives.

Extension of Two Months for Filing Malaysia Income Tax 2020. You might just forget to fill up that LHDN form on timePlease note that the deadlines for tax filing are 30th April 2022 and 15th May 2022 for manual filing and e-Filing respectively. Individual income tax return No business income With business income Statutory deadline March 31 2020 April 30 2020 June 30 2020 Existing grace period - based on method of submission Electronic filing 1 month.

Also the MIRB has closed all. The deadline to submit the BE form is on April 30 while it is June 30 for the B form. The Malaysian Inland Revenue Board on 19 August 2021 announced an additional one-month extension of time to file income tax returns for 2021.

For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing. The total eligible tax rebate self husband wife is restricted to individuals. Individual Tax Relief in Malaysia.

We would like to remind all taxpayers including sole proprietors and partners to file their income tax returns. Date of online submission may subject to change. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

The Inland Revenue Board of Malaysia LHDN has extended the tax payment deadlines for taxpayers and employers affected by the recent floods. Married with 2 Children. As for those filling in the B form resident individuals who carry on business the.

By 30 April without business income or 30 June with business income in the year following that YA. Malaysia Various Tax Deadlines Extended Due to COVID-19 Malaysia Various Tax Deadlines Extended Due The Malaysian Inland Revenue Board MIRB has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the COVID-19 crisis. As the first deadline to file your income tax has just passed you may be wondering what could happen if you file your taxes late.

Individuals resident non-resident individuals including knowledge expert workers partnerships associations. 2022 tax filing deadlines. Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis.

Business income e-B on or before 15 th July. Extended from 15 July 2021 to 31 Aug 2021 according to LHDN. Although a partnership is not subjected to pay tax it still has to file an annual income tax return Form P to show all income earned and business expenses.

If youre self-employed for instance then the deadline is June 30th. For Labuan entities taxed under the Malaysia Income Tax Act 1967 ITA the 3-months extension only applies to taxpayers whose accounting period ended on 30 November 2020 and 31 December 2020The tax submission deadline under ITA is usually within 7 months after the end of accounting period. 2021 income tax return filing programme issued.

The deadline for filing your tax return depends on where your income comes from. Personal income tax filing Form BE deadline. The income tax deadline is usually on April 30 manual submission or May 15 e-Filing so you could set it some time at the start of April to give yourself extra time if anything goes wrong.

Business income B Form on or before 30 th June. The Government has announced an extension of two months for filing income tax from the original deadline in consideration of the Movement Restriction Order MRO that has been enforced during the COVID-19 pandemic. Of tax professionals will be able to assist you in the aspect of tax planning and compliance so as to comply with the Income Tax Act.

Income tax return for partnership. Tax Offences And Penalties In Malaysia. The new deadline for filing income tax returns in Malaysia is now 30 June 2020.

SOLE PROPRIETOR Form B. The 2021 filing programme is broadly similar in concept to the position laid out in the. The tax filing deadline for person by 30 April in the following year.

Meanwhile for the B form resident individuals who carry. Individual Tax in Malaysia. Form B Form B deadline.

Deceased persons estate Association. For further information kindly refer the Return Form RF Program on the. The Malaysian tax year runs from January 1st - December 31st.

Tax Deadline Year 2022. Income tax return for individual with business income income other than employment income Deadline. However if you derive income from employment then you have to file your taxes before April 30th.

Declaration report of companies Form E deadline. Extended grace period for filing. Income tax return for partnerships.

Personal Income Tax Deadline Reminder. PERSONAL TAX Form BE 30 April 2022.

1099 Tax Return Contractors Small Business Freelancer Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Benefits Of Life Insurance Life Insurance Facts Benefits Of Life Insurance Life And Health Insurance

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

2022 Income Tax Return Filing Programme Issued Ey Malaysia

Lhdn Tax Filing Deadline Extended By 2 Months Rsm Malaysia

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Tax Season 2021 How To Get A Bigger Quicker Tax Refund Usa Today Tax Refund Tax Season Tax

𝗧𝗮𝘅 𝗳𝗶𝗹𝗶𝗻𝗴 𝗗𝗲𝗮𝗱𝗹𝗶𝗻𝗲𝘀 𝗳𝗼𝗿 𝟮𝟬𝟮𝟭 Ks Chia Associates Facebook

Southeast Asia S Bubble Tea Craze The Asean Post Flavored Tea Bubble Tea Bubble Tea Flavors

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

View Full Version Here Http Www Imoney My Articles Bankruptcy Infographic Bankruptcy Reality Check

View Full Version Here Http Www Imoney My Articles Bankruptcy Infographic Bankruptcy Reality Check

Important Dates For 2022 Tax Returns Leh Leo Radio News

Internet Web Hosting Is Essential For The Business To Deliver Online Sales Growth Web Hosting Hosting Website Creation

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Tax Filing Deadline 2022 Malaysia